Revaluing an Asset

An asset may need to be revalued to meet current market values.

Note: The Revalue Asset function affects an asset’s Book values only – it does not affect Tax values.

To revalue an asset:

-

Open the asset, then click the Revalue Asset toolbar button.

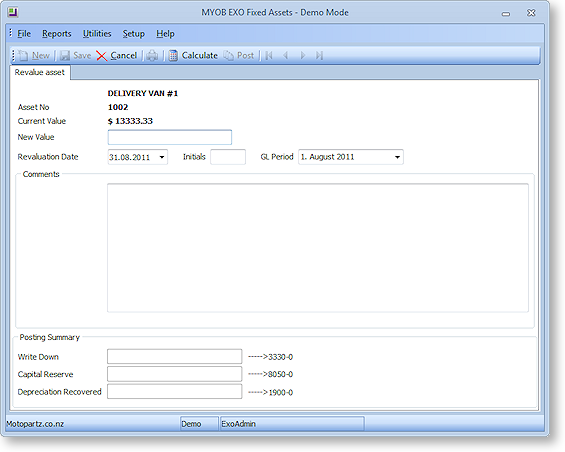

The Revalue asset tab displays:

-

Enter values for each field:

Field

Description

New Value

The value of the item based on revaluation.

Revaluation Date

The date the revaluation is carried out.

Initials

The initials of the staff member handling the revaluation. This can be useful if any clarifications are required at a later stage.

GL Period

The General Ledger period that revaluation transactions should be posted to.

Comment

Any relevant information such as the source providing the revaluation figures.

-

Click the Calculate button. The fields in the Posting Summary panel are automatically completed.

-

Click the Post button.

Note: Following a revaluation it is normal to re-assess the remaining useful life of an asset. This may require you to change the Depreciation Rate – for example, if there are only two more years of useful life, then change the Straight Line Depreciation Rate to 50%. Subsequent Depreciation is calculated as the New Asset Value times the New Rate for the number of days from the last revaluation date up until the new depreciation date.